A small estate affidavit is regulated by the State a person died in as a form that may be used when a will was not written at the time of death. Therefore, the rightful heirs, which is usually the direct family members and/or spouse, may make a request through the respective probate court to “fast-track” the process. All funds shall be administered by the court process and if there is more than one rightful heir to the assets the courts shall administer accordingly.

Depending on the State, the amount under the estate cannot be more than anywhere from $5,000 to $100,000. If you feel you are the rightful heir to funds, or you and a collection of family members, then this form should be carefully filed with the probate office in your jurisdiction.

Forms by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How to Write

This is a guide on how to write a generic form in either Adobe PDF or Microsoft Word (.docx)

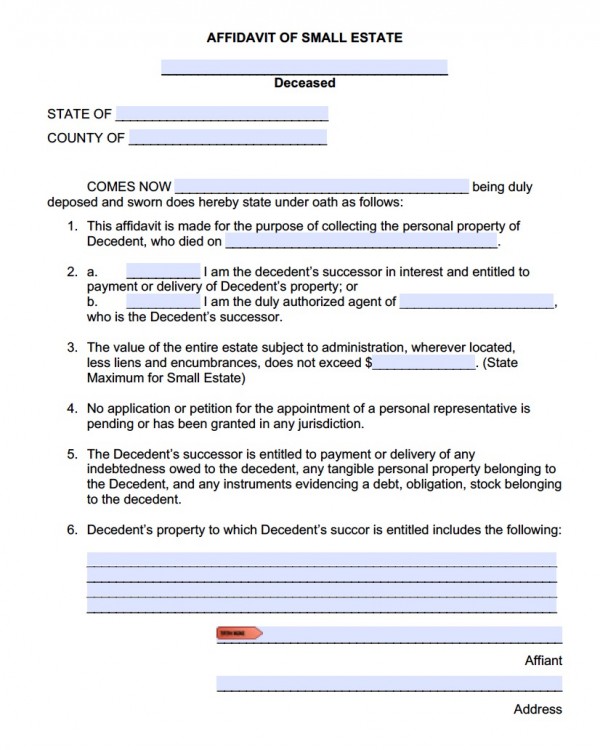

Step 1 – In the heading enter the following:

- Name of the deceased;

- State and County where the person died;

Step 2 – In the body of page 1 continue:

- the Affiant’s name;

- Date of death;

- Mark whether you are the deceased’s successor or authorized agent;

- The maximum amount for a small estate as limited by the State of the deceased;

- List all of decedent’s property;

- Affiant’s Signature and address.

Step 3 – On page 2 the Affiant must present at least two people (witnesses) that knew the decedent and have no monetary interest to gain for stating they believe the Affiant to be the rightful heir to any and all property/assets. They must sign their names in the presence of a notary public and the form may then be submitted to the according Probate County office.

Generic in PDF and Word