In New Hampshire, joint tenancy laws allow any property owned jointly to pass directly to the other owner in the event of one owner’s death. However, if there is not another real estate owner, and the decedent passed away without a last will and testament, successors such as spouses, relatives, or others may file the small estate affidavit to avoid real estate valued below a certain dollar amount to pass to probate court. That way, a grieving family may disperse and/or sell the property as they see fit, without the expense of an attorney or the time-consuming pain of going to court. This small estate affidavit ruling is per New Hampshire statute NHJB-2141-P.

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

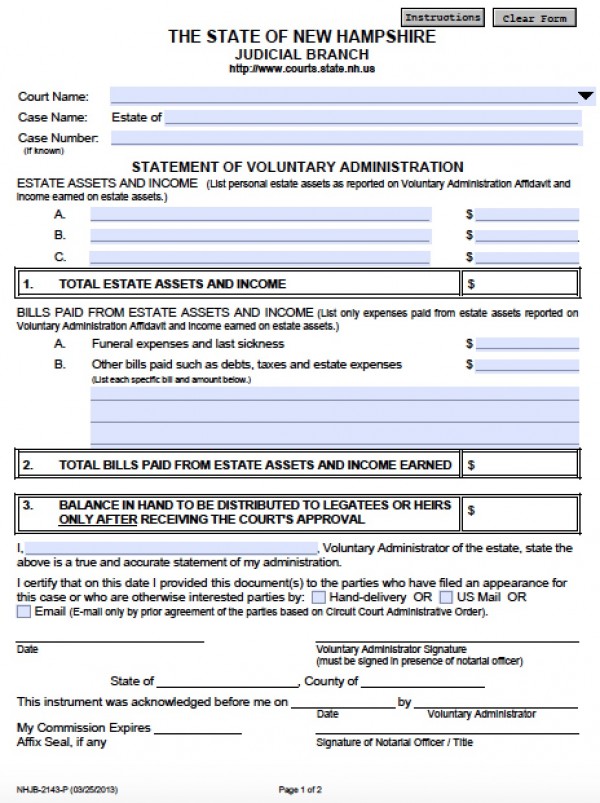

Step 2 – Enter the following into the form:

- Header – Enter Superior Court (See List)

- Name of Decedent

- Date of Birth

- Case Number

- Check the three (3) boxes depending on your situation

- Date and Sign

- Verification – On the last page you will be required to verify that everything you have stated is true and accurate

Step 3 – Bring a certified copy of the death certificate and file the form with the proper clerk or courthouse.