In New York state, a surviving spouse may file an affidavit of heirship to collect up to $50,000 of the loved one’s estate. However, the affidavit must be filed with the state’s probate court so that a judge may distribute some of the private property, such as bank accounts and trusts, among other heirs, including children and creditors. Creditors and certain relatives may collect up to $15,000, based on entitlement. However, if the affidavit of heirship is filed 6 months after the decedent’s passing, then relatives and creditors can only receive up to $5,000. The affidavit of heirship is governed by SCPA 1310.

How to Write

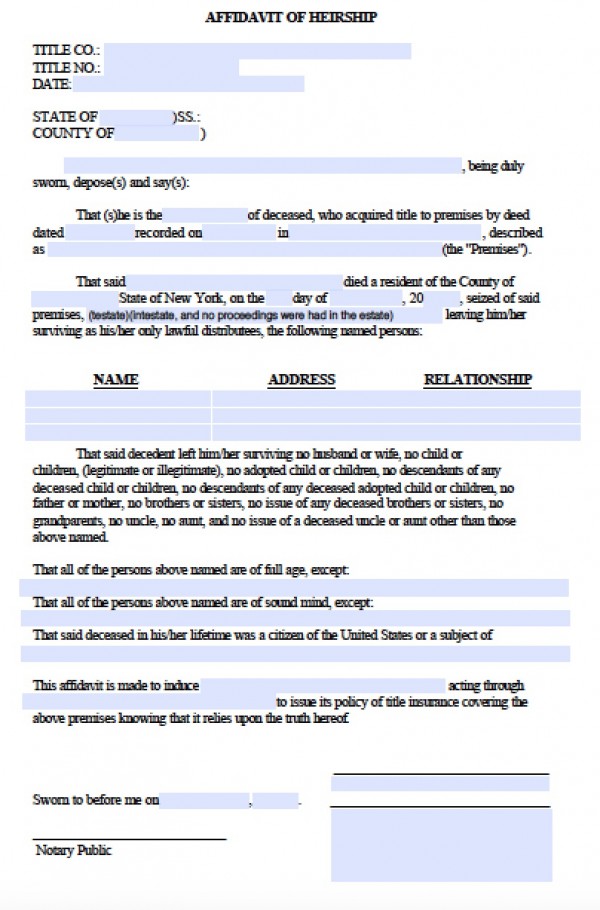

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Bring a certified copy of the death certificate and sign the document before a notary public.