An affidavit of heirship is a form that may be used by the rightful family member of someone who died and did not leave a will. The document is mainly for the use of real estate that was left by the deceased and did not have a written will stating who or where the land would belong to after their death. The form is to be filed by the remaining family member(s) with the county office that regulates deeds.

According to most States, the form must be signed by one (1) or two (2) individuals that knew the deceased and can stand-by the applicant’s claim that there is no other family or spouse that has rights to the premises. If approved by county deed’s office, the land/property shall be transferred to the new owner.

Forms by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How to Write

It is recommended to use one of the above State specific forms but if you would like to download a generic affidavit of heirship in either Adobe PDF or Microsoft Word (.docx) you may do so in order to use at your county deed office (or probate).

The steps below are how to fill-in the standard type for all States.

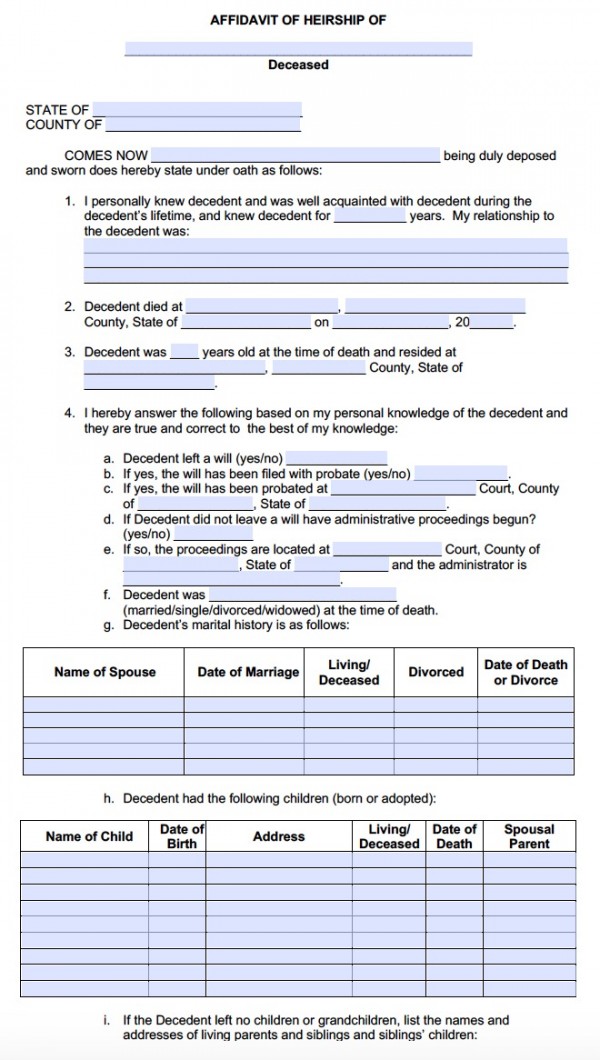

Step 1 – Download the document in Adobe PDF or Microsoft Word (.docx) and enter the decedent’s name in the header along with the County and State where they died. Enter the affiant’s name (the person(s) making the claim to the property/real estate).

Step 2 – In Section 1, enter the number of years the affiant knew the person who died and the relationship.

Step 3 – In Section 2, enter the Time and Address of death including County, State, and Date.

Step 4 – In Section 3, enter the age of the decedent at the time of death and their residing address.

Step 5 – In Section 4, enter the following:

- Did the decedent leave a will?

- If yes, was the will filed with the county of probate?

- If yes, enter the jurisdiction name and county of the probate court

- If the decedent did not leave a will, have administrative proceedings begun?

- If yes, enter the county where the proceedings have begun

- What was the marital status of the decedent?

Step 6 – In the first (1st) set of table cells, enter all the spouses of the decedent during their lifespan including:

- Name of spouse;

- Date of marriage;

- Are they still living?;

- Were they divorced at the time of death?;

- Date of their death or divorce

Step 7 – In the second (2nd) set of tables enter the children’s information including:

- Name of child;

- Date of birth;

- Address;

- Living/deceased;

- Date of death;

- Spousal parent

Step 8 – If the decedent had no children list all living family members including parents, siblings, grandchildren, etc.

Step 9 – List the real property the decedent left behind.

Step 10 – If there were any unpaid taxes or debts of the decedent, list them.

Step 11 – Affiant should sign the form in the presence of a notary public and the form is complete and ready for filing.