According to Nevada’s statutes Nev. Rev. Stat. Ann. § 146.080, amended by 2105 Nevada Laws Ch. 169 (A.B. 130), successors not directly related to the decedent may file an affidavit of heirship for personal property valued up to $20,000. If a surviving spouse files, then the estate may value up to $100,000; other surviving family members may file for estates up to $25,000. This includes bank accounts, stocks, retirement accounts, vehicles, heirlooms, and other types of personal property that might have a high value.

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

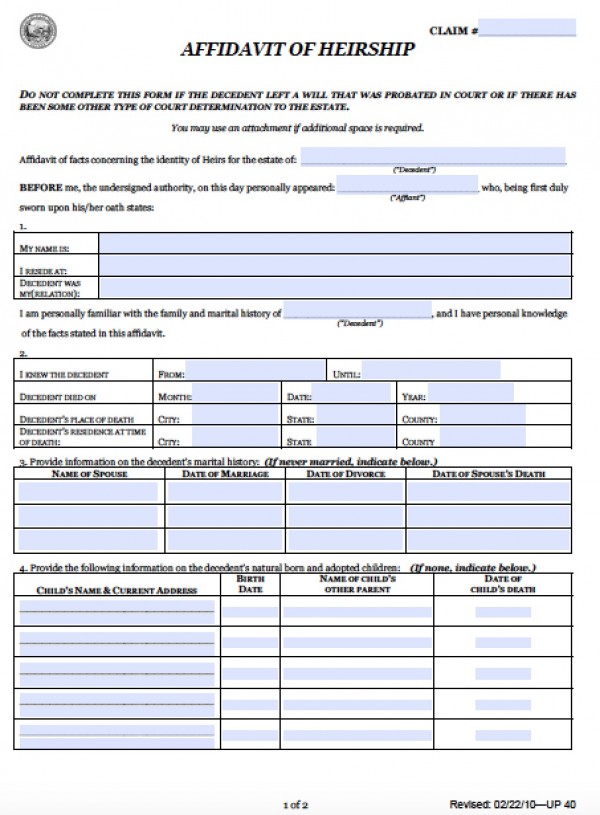

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Obtain a notarized copy of the death certificate, and sign the document with a notary public.