When 30 days have passed after the death of a loved one who resided in Massachusetts, the successors may file an affidavit of heirship to collect the decedent’s personal property. This property includes bank accounts, heirlooms, vehicles, 401(k)’s, and any other property that may have a high value. However, the property may not exceed $25,000 in value or it will go automatically to probate court for administration. Massachusetts statutes Mass. Gen. Laws Ann. §§ 3-1203, 1204 cover the details of affidavits of heirship.

How to Write

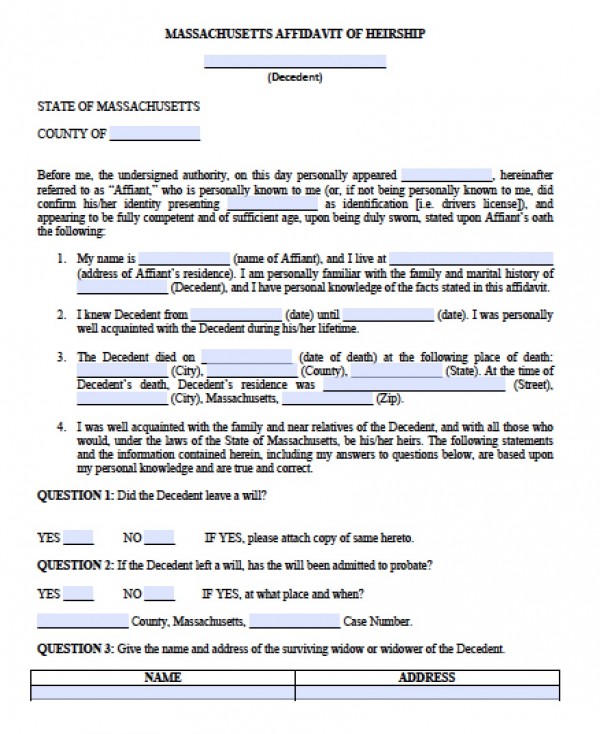

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Obtain a notarized copy of the death certificate, and sign the document with a notary public.