If a person living in Kansas passes away, or they own property in the state, their heirs may file an affidavit of heirship to claim their loved one’s personal property as long as the estate values less than $40,000. These assets are most often bank accounts, but can include other personal property such as vehicles or heirlooms. The affidavit of heirship may also be used to collect any debts owed to the decedent, such as final paychecks. The statute governing this affidavit in Kansas is Kan. Stat. Ann. § 59-1507b.

How to Write

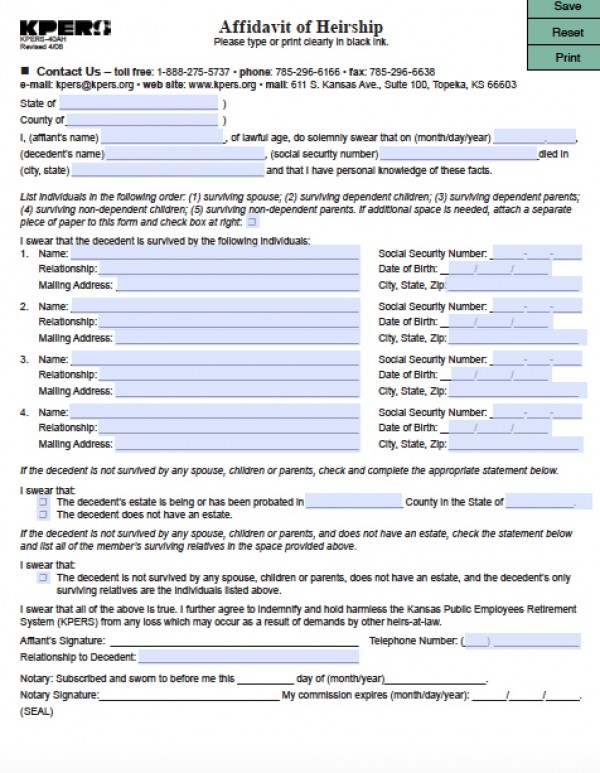

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Obtain a notarized copy of the death certificate, and sign the document with a notary public.