Texas defines “small estates” as those valuing $75,000 or less. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court. If there is no will, or the court determines the successors may administer the will themselves, then the Texas affidavit of heirship allows those successors to divide the decedent’s personal property as they see fit. This affidavit is governed under Tex. Est. Code § 205 as of 2014, as well as Tex. Prob. Code Ann. § 137.

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

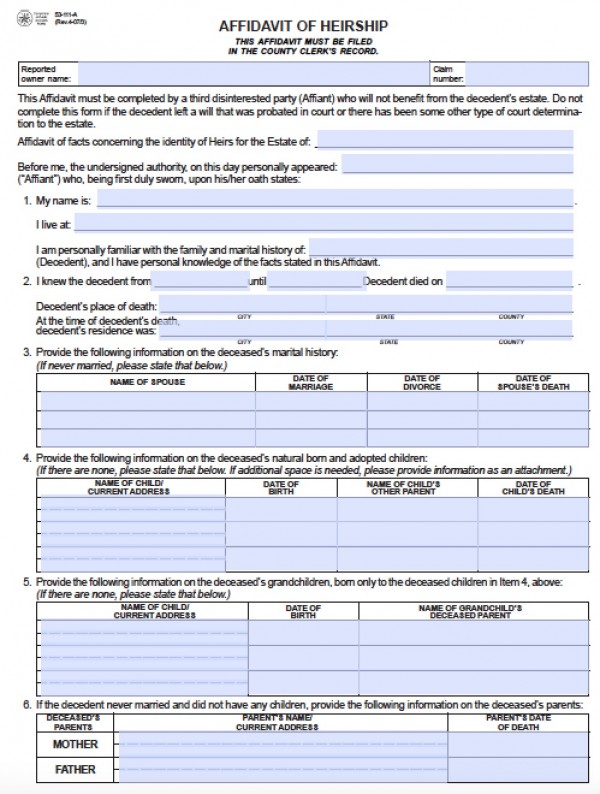

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Sign the document before a notary public, and file with a copy of the death certificate.