In Tennessee, a general affidavit of heirship does not include vehicle titles. However, this affidavit does include bank accounts, tangible property, and debts owed the decedent like final paychecks. Successors may wait 45 days before filing the affidavit of heirship in Tennessee, and must decide on a voluntary administrator, called an “affiant,” to protect, index, and distribute the property appropriately. In addition, creditors with evidence of the decedent’s debts may file an affidavit of heirship to collect on the debts. Per Tenn. Code Ann. §§ 30-4-102 and following, the value of the estate may not exceed $50,000.

How to Write

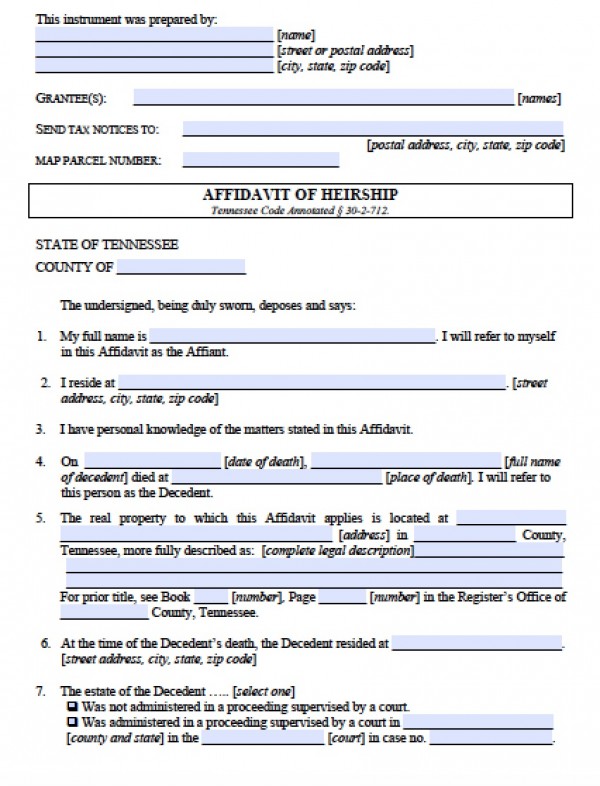

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Sign the document before a notary public, and file with a copy of the death certificate.