The Oregon affidavit of heirship is covered by statutes ORS 114.505 to 114.560. The successor(s) may file 30 days after the decedent passes away, and the value of personal property including bank accounts, trusts, debts like final paychecks, life insurance policies, and heirlooms cannot exceed $75,000. The decedent may have a will, but affidavits cover finances and items that are not covered in the will. The state specifies that certain successors may file, as long as the successor has been listed in the decedent’s will, is a blood relative, or a surviving spouse.

How to Write

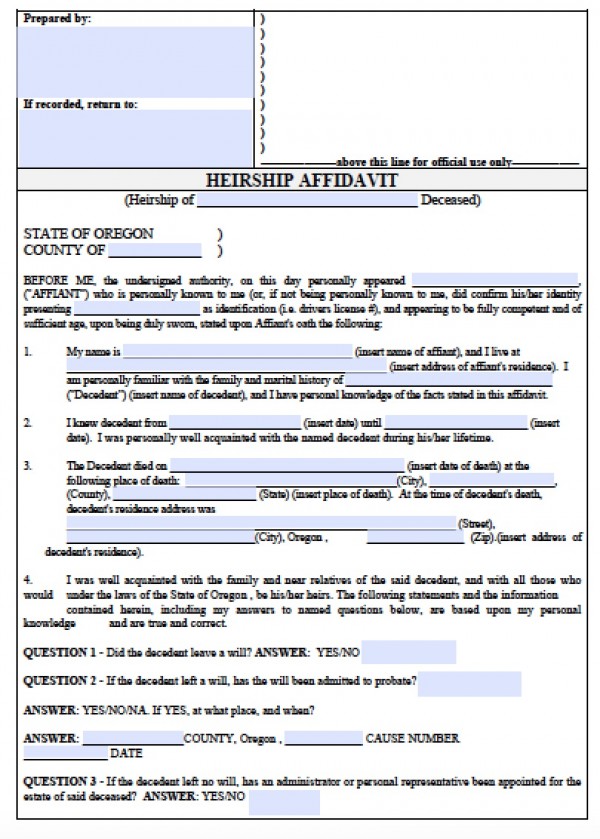

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Bring a certified copy of the death certificate and sign the document before a notary public.