Oregon small estate affidavits may be filed by successors to claim an estate or other tangible property left by a decedent, as long as it values less than $$275,000 ($75,000 for personal property; $200,000 for real property). The state requires specific successors to file – surviving spouses, blood relatives, or successors listed in the decedent’s last will and testament, if there is one. Business property under a sole proprietorship or small business may also be passed down to heirs.

Laws – § 114.515

How to Write

Step 1 – Download in Adobe PDF.

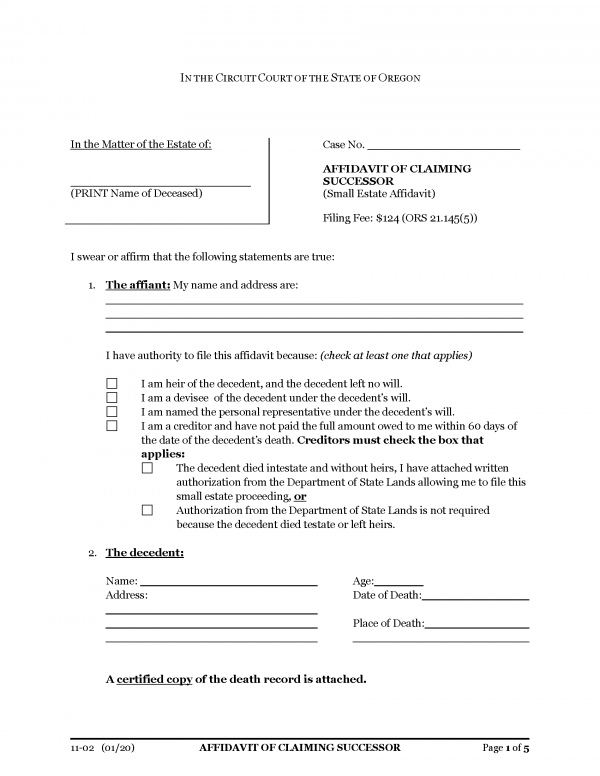

Step 2 – Enter the following into the form:

- Header – Enter Superior Court (See List)

- Name of Decedent

- Date of Birth

- Case Number

- Check the three (3) boxes depending on your situation

- Date and Sign

- Verification – On the last page you will be required to verify that everything you have stated is true and accurate

Step 3 – Bring a certified copy of the death certificate and file the form with the proper clerk or courthouse.