If there are enough assets to pay debts and taxes, and the successors agree there will be no disputes about how to distribute the personal and tangible property of a deceased loved one, then they may file the affidavit of heirship to claim bank accounts, vehicles, and other items of personal property not including real estate. This allows family members to avoid probate court. The value of the estate may not exceed $100,000, but there is no waiting period in West Virginia, per W. Va. Code § 44-3A-5.

How to Write

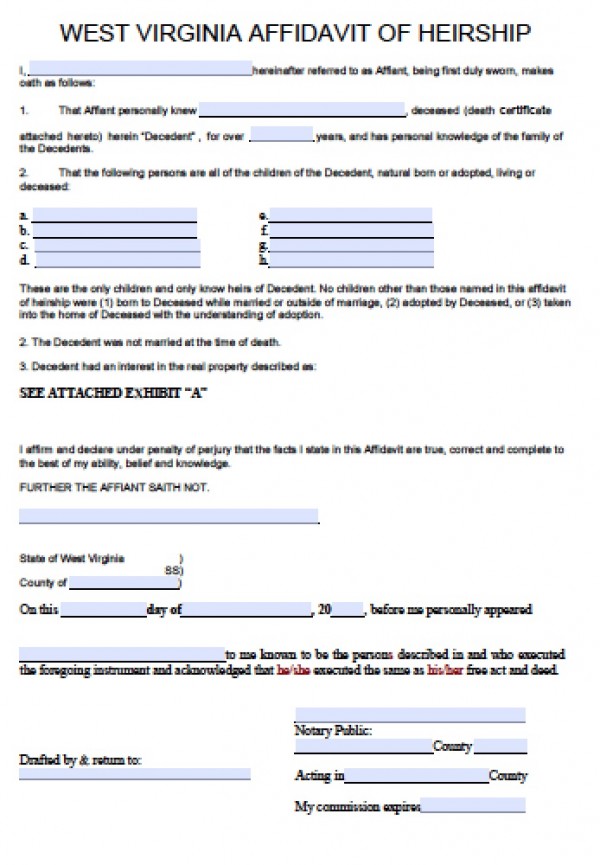

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Sign the document before a notary public, and file with a copy of the death certificate.