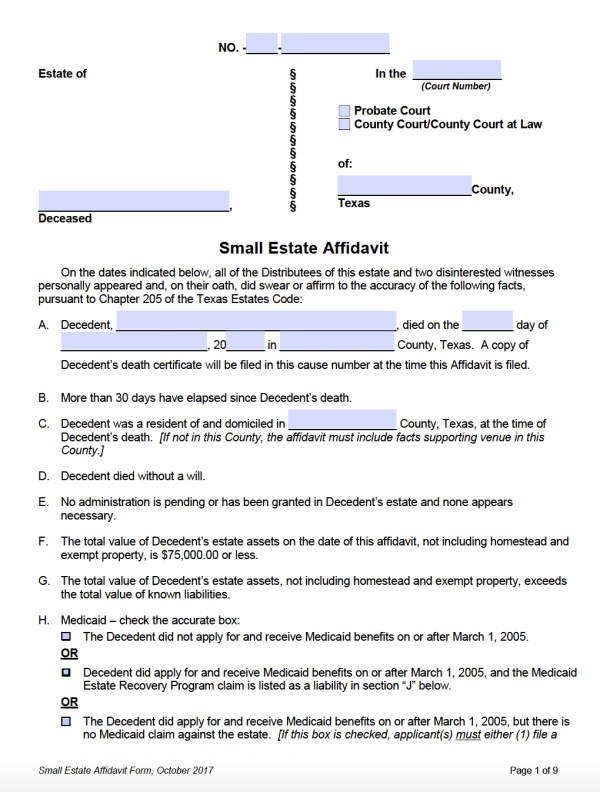

The Texas small estate affidavit may be filed when either loved ones of a deceased family member, heirs, or creditors with evidence of the decedent’s debts, to take possession of the property and assets of a deceased person. This only may be used when there is no will and the family wishes to avoid probate court. An accounting of all the assets may not be more than $75,000 in accordance with Sec. 205.001. Otherwise, the estate of the decedent will be required to go through the probate process.

By County

Other Versions

How to Write (Generic Form)

Step 1 – Download in Adobe PDF

Step 2 – Enter the following into the form:

- Header – Enter Superior Court (See List)

- Name of Decedent

- Date of Birth

- Case Number

- Check the three (3) boxes depending on your situation

- Date and Sign

- Verification – On the last page you will be required to verify that everything you have stated is true and accurate

Step 3 – File the form with a copy of the death certificate to the proper clerk or courthouse.