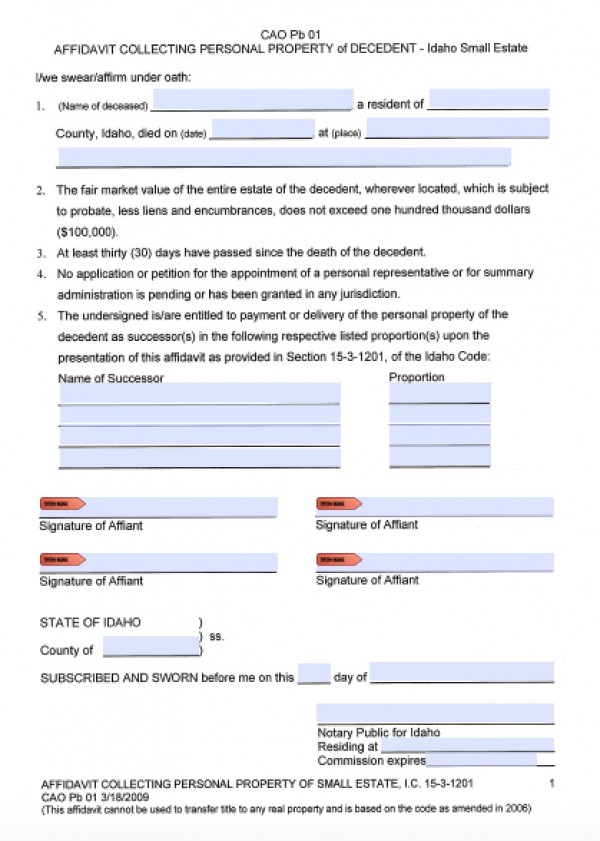

If a loved one passes away in Idaho, the successors may avoid probate court by filing a small estate affidavit to collect real estate owned by the decedent. This property at fair market value, minus taxes, liens, and other expenses, may not value more than $100,000. In addition, the real estate may not exceed the “homestead allowance,” as discussed under Idaho Code §§ 15-3-1203.

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Enter the following into the form:

- Header – Enter Superior Court (See List)

- Name of Decedent

- Date of Birth

- Case Number

- Check the three (3) boxes depending on your situation

- Date and Sign

- Verification – On the last page you will be required to verify that everything you have stated is true and accurate

Step 3 – Obtain a notarized copy of the death certificate, and file the form with the proper clerk or courthouse.