In South Carolina, statute sections 62-3-1203 and 1204 determine that a personal representative for the decedent must close down the estate and distribute the personal property and real estate after notifying a decedent’s creditors of their death. Creditors may take any financial obligations out of the estate, which to avoid probate court may not value more than $25,000 less liens and encumbrances (like mortgage payments). After that, the representative may take the real estate property using a small estate affidavit and divide the property among heirs, keep it for themselves, or sell it, depending on their relationship to the decedent and whether or not there are other heirs.

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

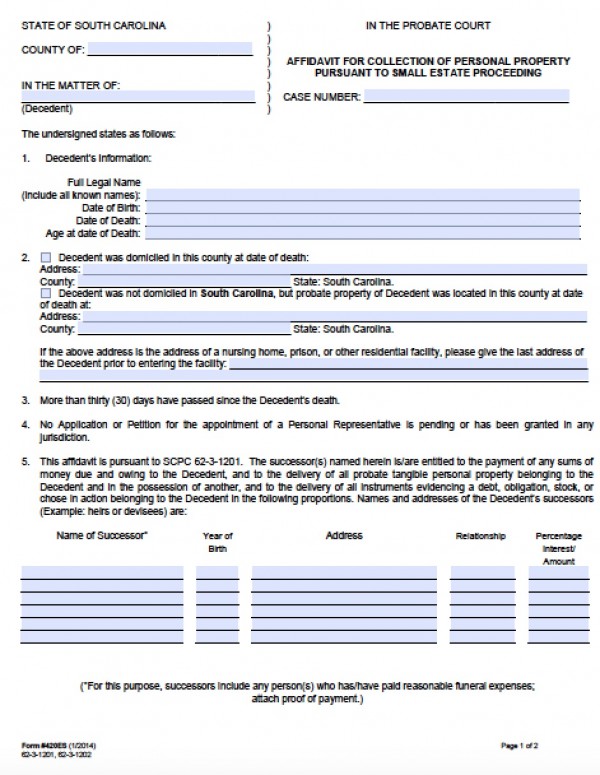

Step 2 – Enter the following into the form:

- Header – Enter Superior Court (See List)

- Name of Decedent

- Date of Birth

- Case Number

- Check the three (3) boxes depending on your situation

- Date and Sign

- Verification – On the last page you will be required to verify that everything you have stated is true and accurate

Step 3 – File the form with a copy of the death certificate to the proper clerk or courthouse.