Per Kentucky’s statute KRS 382.335 & 382.240, successors may file for their deceased loved one’s personal property – such as bank accounts, 401(k)’s, and even final paychecks – by submitting a completed affidavit of heirship. The decedent’s estate may not exceed $15,000, or it will go automatically to probate court for distribution if there is no last will and testament. If the affidavit of heirship is filed within 2 years, the family or other successors may claim the decedent’s personal or real property and distribute it as they find appropriate.

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

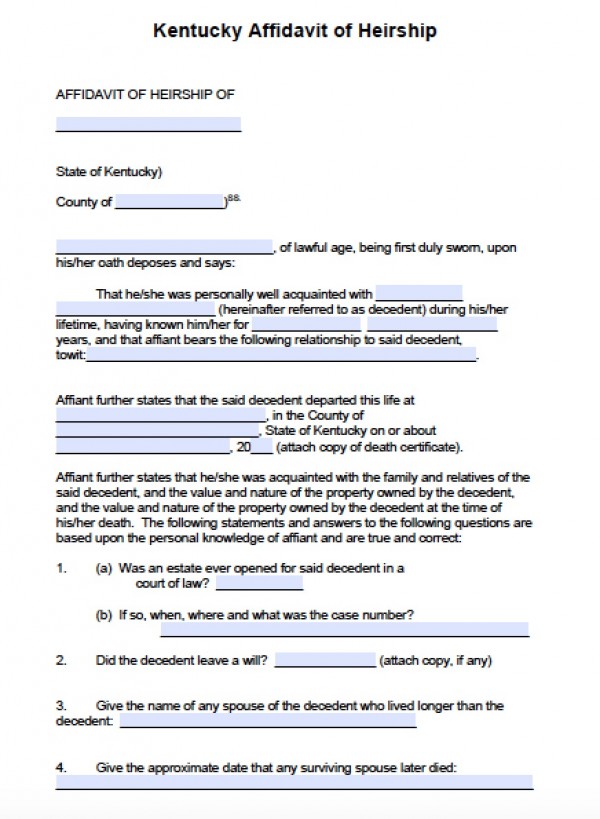

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Obtain a notarized copy of the death certificate, and sign the document with a notary public.