According to the Louisiana Code of Civil Procedure, under articles 3421, 3431, 3432, 3432.1, and 3434 clarifies that “small” succession as “the succession or the ancillary succession of a person who has died at any time, leaving property in Louisiana having a gross value of seventy-five thousand dollars or less valued as of the date of death.” If the personal or real property of a Louisiana resident values at $75,000 or less – and this includes bank accounts, retirement accounts, and even final paychecks – then successors may file the affidavit of heirship to collect and distribute the decedent’s personal property without going to probate court.

How to Write

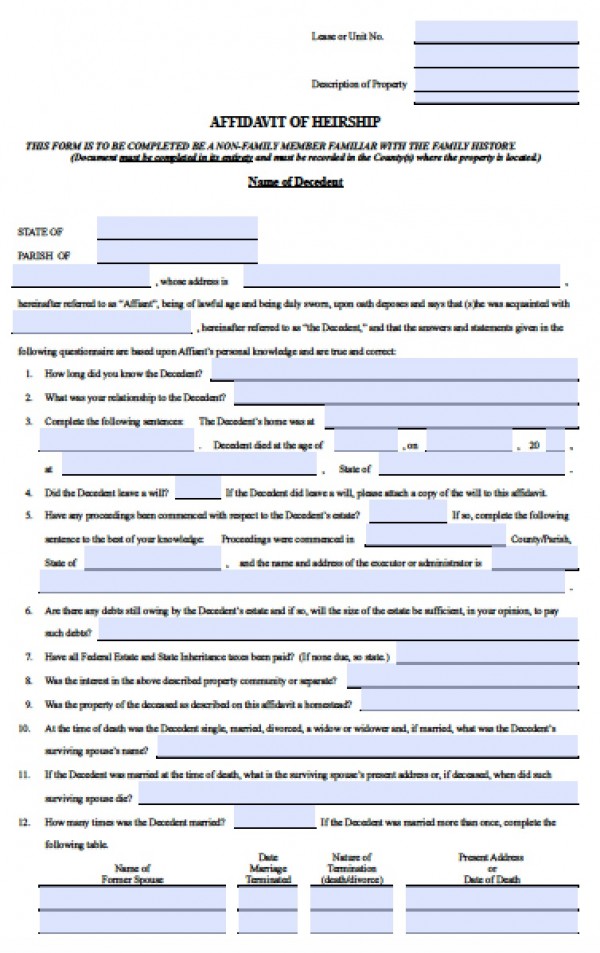

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Obtain a notarized copy of the death certificate, and sign the document with a notary public.