If a person dies in Hawaii and has no will or trust, their loved ones – whether direct family or other successors – may apply for an affidavit of heirship to transfer real or personal property into the successors’ name(s). The property must value less than $100,000 and cannot include real estate. However, the affidavit of heirship does cover bank accounts, vehicles, jewelry and heirlooms, and other items that might be of high value. This form may be filed within a few years of the decedent’s passing. This process is governed by Hawaii Revised Statutes Section 560:3-1201 & 1201.

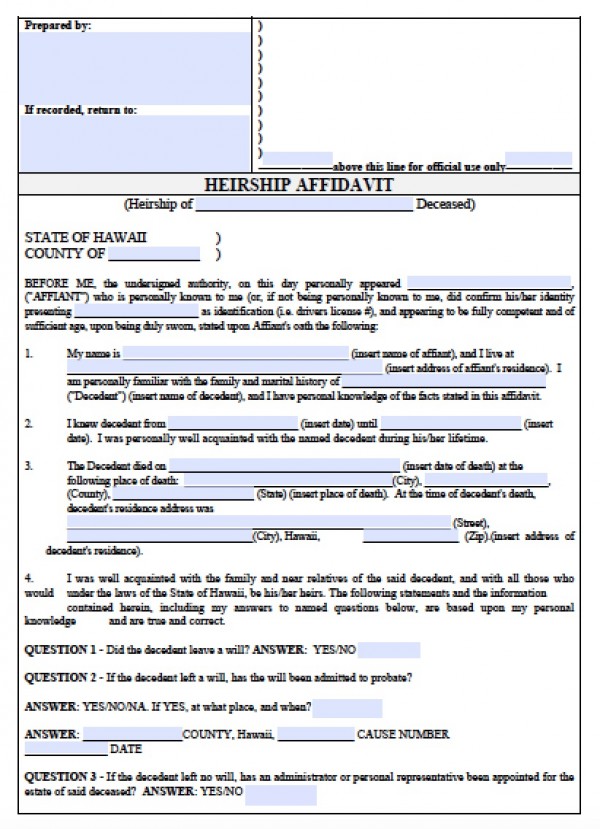

How to Write

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Obtain a notarized copy of the death certificate, and sign the document with a notary public.