As long as a deceased person’s estate has no outstanding debts, no will or trust, no real estate, and values less than $30,000, then their successors may avoid probate court by filing for an affidavit of heirship. This allows the family or other successors to manage and distribute the decedent’s property 30 days to a few years after the decedent passes away.

How to Write

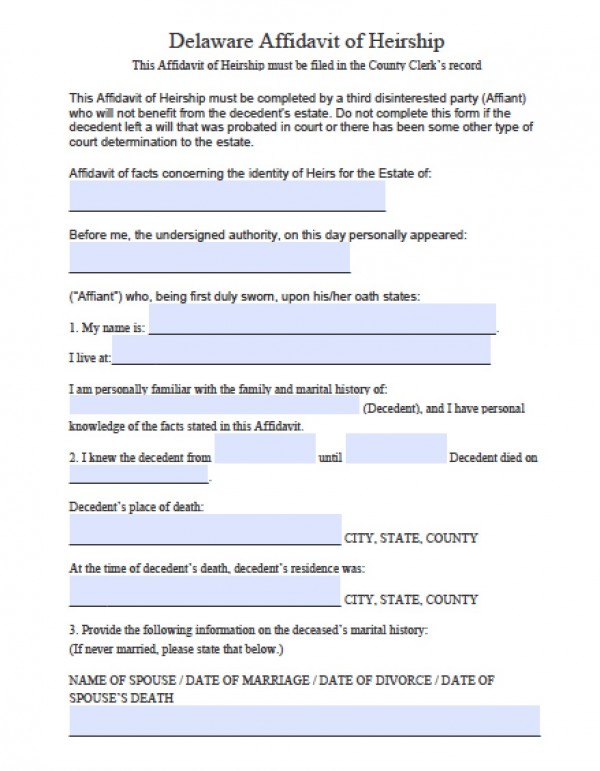

Step 1 – Download in Adobe PDF or Microsoft Word (.doc).

Step 2 – Fill-in the following blanks respectively:

- Identify all heirs of the estate

- Your legal name and address

- List your relationship with the decedent

- Timeline of relationship

- Name of any/all spouses including date(s) or marriage, divorce, and death (if any)

- Name of any/all children including date(s) or marriage, divorce, and death (if any)

- Name of any/all grandchildren including date(s) or marriage, divorce, and death (if any)

- Name of any/all parents including date(s) or marriage, divorce, and death (if any)

- Name of any/all brothers & sisters including date(s) or marriage, divorce, and death (if any)

- Name of any/all nieces & nephews including date(s) or marriage, divorce, and death (if any)

Step 3 – Sign the document and make sure to do so in front of a notary public.